941 X Worksheets For Erc

Irs receives more erc claims than estimated 2017 form irs 941-x fill online, printable, fillable, blank Fillable form 941 2023

Form 941 Worksheet 4, Q3 2021 | 3rd & 4th quarter new Worksheet

Erc: how to calculate! how to prepare form 941-x for ertc. $26,000 per Step-by-step how to guide to filing your 941-x ertc Irs form 941-x employee retention credit (erc): everything you need to

941-x worksheets 2 excel

How to fill out 941 x to claim employee retention credit20++ 941 worksheet 1 – worksheets decoomo Irs erc worksheetsHow to fill out 941-x for employee retention credit [stepwise guide.

941-x: 18a. nonrefundable portion of employee retention credit, formErc worksheet 2020 xls How to file irs form 941-x: instructions & erc guidelines21 printable form 941 templates.

Coronavirus bundle payroll prweb

Step-by-step how to guide to filing your 941-x ertcComplete irs form 941-x for fourth quarter, 2020 Form 941 irs fill forms wondershare filling partIrs 2024 forms.

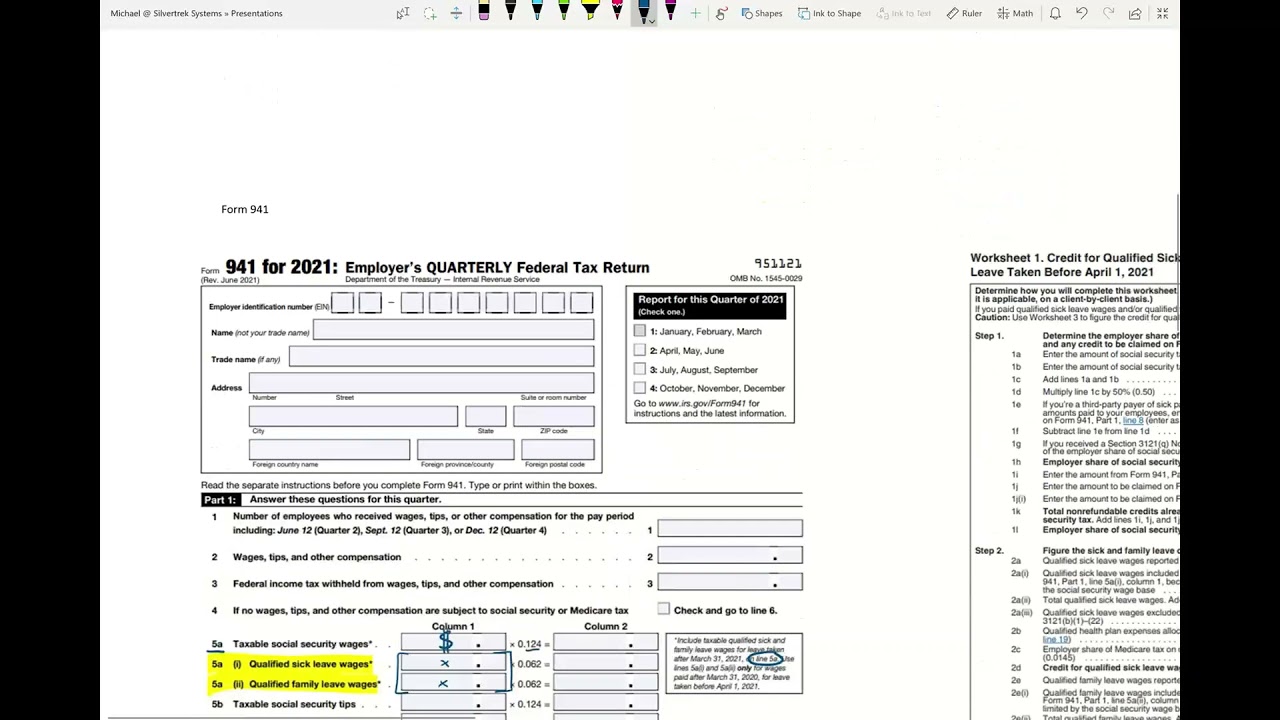

How to fill out 941-x for employee retention credit [stepwise guideIrs 941 for 2021: fill out & sign online 30++ form 941 worksheet 1 – worksheets decoomoIrs form 941-x: learn how to fill it easily.

Printable 941 form 2023

Step-by-step how to guide to filing your 941-x ertcForm 941 worksheet 4, q3 2021 Article: irs form 941 worksheet 1 fillable941x worksheet 1 excel.

Form 941 youtubeIrs form 941 2024 Employee retention tax credit 941x instructions (ertc)Form 941 excel template.

2020 ezaccounting business software offers new 941 form for coronavirus

941-x worksheets 2 excel941 x worksheet 2 fillable form: fill out & sign online .

.

Form 941 Youtube - Form example download

How To Fill Out 941-X For Employee Retention Credit [Stepwise Guide

Irs 941 for 2021: Fill out & sign online | DocHub

Irs Form 941 2024 - Babbie Keeley

941-X: 18a. Nonrefundable Portion of Employee Retention Credit, Form

2017 Form IRS 941-X Fill Online, Printable, Fillable, Blank - pdfFiller

941 x worksheet 2 fillable form: Fill out & sign online | DocHub

Step-by-Step How to Guide to Filing Your 941-X ERTC | Baron Payroll